Past Events

| Date |

Topic (Click the title for a complete description of the event with handouts where available) |

| November 12, 2025 |

Federal Funding & Fiscal Futures in the Municipal Market |

| October 23, 2025 |

The Charter School Landscape—Current Realities and Emerging Trends |

| September 25, 2025 |

Distressed and Defaulted Credits |

| June 24, 2025 |

Scrum and Happy Hour |

| May 15, 2025 |

Affordable Housing |

| April 17, 2025 |

Fireside Chat with NYS Comptroller Tom DiNapoli |

| March 19, 2025 |

Putting Tariffs in Perspective |

| February 13, 2025 |

Natural Disasters: The Risk to People and Places |

| January 16, 2025 |

Navigating an Uncertain and Evolving Healthcare Industry |

| December 18, 2024 |

Holiday Party |

| November 14, 2024 |

Election 2024 Update with Emily Brock |

| October 10, 2024 |

Energy Transition: Navigating Opportunities and Challenges |

| September 18, 2024 |

An Inside Look at the Country's Largest Public Works Project with Gateway Development Commission CFO Pat McCoy |

| June 13, 2024 |

You're the Bankruptcy Lawyer - Interactive Panel |

| May 16, 2024 |

Deciphering Population Shifts, Housing Needs, and Fiscal Realities |

| April 18, 2024 |

Navigating Evolving Business Opportunities in the Municipal Bond Market |

| March 14, 2024 |

Understanding How Federal Decisions and Economic Conditions Impact Municipal Bond Markets |

| February 15, 2024 |

Technology: Another Tool in an Analyst's Toolbox |

| January 18, 2024 |

Changing the Garden State: A Fireside Chat with New Jersey Governor Phil Murphy |

| December 12, 2023 |

Holiday Party |

| November 13, 2023 |

Back on Track - What's Ahead for the MTA in 2024 and Beyond |

| October 31, 2023 |

Rural Hospitals and Life Plan Communities: Predicaments and Opportunities Confronting the Muni Market's Two Most Pressured Sectors |

| September 7, 2023 |

2024 Municipal Bond Outlook – Rising Rates Making Issuers Irate, While Investors Elate |

| June 8, 2023 |

Fourth Annual Analyst Scrum and Cocktail Party - The Career Remix Edition |

| May 25, 2023 |

Water Security in a Changing Environment |

| April 20, 2023 |

Investing in Social Impact: A New Frontier of Muni Analysis |

| March 23, 2023 |

Higher Education: Moving Forward after the Pandemic |

| February 16, 2023 |

Trends and Challenges in Charter School Bond Financings |

| January 25, 2023 |

The Future of Cities |

| December 15, 2022 |

In-Person Holiday Party |

| November 30, 2022 |

What will the Midterm Election Results Mean for Federal Policy? |

| October 13, 2022 |

Healthcare Strategy During Uncertain Times – Paving the Way for Success |

| September 15, 2022 |

Navigating U.S. Economic Stresses: Can Munis Maintain Stability in a High-Inflation Environment? |

| June 23, 2022 |

NYC Mega Projects Update |

| May 11, 2022 |

Solving the Affordable Housing Crisis: Evaluating Challenges and Opportunities |

| April 20, 2022 |

Decarbonization of Transportation and Power Utilities |

| March 23, 2022 |

Mass Transportation after the Pandemic |

| February 16, 2022 |

Will the structural shifts in the commercial real estate market catalyzed by COVID-19 permanently impact municipal tax revenues? |

| January 21, 2022 |

Efficient or Overwhelming: How is Enhanced Data and Analytics Driving Municipal Analysis? |

| December 15, 2021 |

In Person Holiday Party |

| November 12, 2021 |

Webinar: Meeting the Climate Challenge: Credit Risks to Munis |

| October 8, 2021 |

Webinar: New York City: Will a New Mayor Mean a New Future? |

| June 11, 2021 |

Webinar: Municipal Cybersecurity Risks: Cybersecurity Insights from Issuers - perspectives and challenges with viewpoints from healthcare, utilities and local government sectors |

| May 21, 2021 |

Webinar: Preparing for the Next Rainy Day: How will States Plan for the Next Economic Downturn? |

| April 23, 2021 |

Webinar: New York City: Moving Past the Pandemic |

| March 26, 2021 |

Webinar: Tri-State Transportation: A Conversation with the Port Authority of New York and New Jersey and Regional Plan Association |

| February 26, 2021 |

Webinar: Water: Navigating the Waves of Policy, Regulation and Coronavirus |

| January 22, 2021 |

Webinar: Portfolio Managers' Perspectives on Identifying Value and Navigating Municipal Credit in 2021 |

| December 11, 2020 |

Webinar: Year-End Discussion with Ben Watkins |

| November 20, 2020 |

Webinar: Higher Education: The Future is Not the Past |

| October 16, 2020 |

Webinar: Healthcare Industry Disruption |

| September 11, 2020 |

Webinar: Muni Market Update: The Big Picture |

| June 12, 2020 |

Webinar: ESG Risks: An Investor's Perspective |

| May 6, 2020 |

Webinar: Cybersecurity Professionals on Municipal Cybersecurity Risks |

| May 1, 2020 |

Webinar: COVID-19 Impact on the Municipal Marketplace |

| February 7, 2020 |

Changing Demographics and the Effect on Different Sectors |

| January 10, 2020 |

High Yield Beyond Puerto Rico |

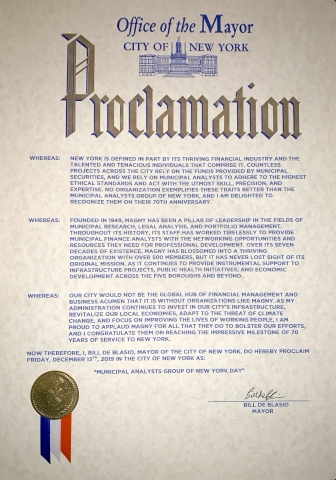

| December 13, 2019 |

Holiday Party/70th Anniversary Celebration |

| November 8, 2019 |

Modern Tools and Techniques for Credit Analysis |

| October 4, 2019 |

Planning for the Unexpected in Budgets and Pensions |

| September 13, 2019 |

Economic Outlook with Paul Gruenwald |

| June 13, 2019 |

Annual Scrum + Cocktail Party |

| May 17, 2019 |

Puerto Rico's Debt Restructuring and Its Implications for the Muni Market |

| April 12, 2019 |

Everything You Always Wanted to Know about Muni Workouts, But Were Afraid to Ask |

| March 8, 2019 |

Climate Change & the Muni Sectors: How Are Actors in Each Sector Planning Ahead? |

| February 8, 2019 |

Big Tech and the U.S. Healthcare Industry: How Technological Change is Reshaping the Sector |

| January 11, 2019 |

U.S. Demographic Change, Ratings, and Interstate Tax Migration |

| November 16, 2018 |

New York City's 'Mega Projects': A Detailed Update |

| October 19, 2018 |

The Future (or lack thereof?) of Muni Credit Enhancement |

| September 7, 2018 |

US State Budget Outlook: Fiscal 2019 |

| June 8, 2018 |

The Next Recession: What to Expect? |

| May 11, 2018 |

ESG and Green Bonds |

| April 13, 2018 |

Federal Tax Reform and the Muni Market |

| March 16, 2018 |

What's New with GASB and what does it mean for municipal credit? |

| February 9, 2018 |

Federal Healthcare Reform Initiatives and Their Impact on the States |

| January 12, 2018 |

Illinois & Chicago: Have the 2017 State Budget Deal and Chicago Sales Tax Securitization Changed the Credit Landscape? |

| November 10, 2017 |

What Next for Puerto Rican Debt? Legal Implications of Court Rulings and Hurricane Maria |

| October 13, 2017 |

Connecticut's New Economic Reality: The Long-Term Budgeting Implications |

| September 8, 2017 |

The Trend Toward Dedicated Revenue and Securitization Structures: More or Less Than Meets the Eye? |

| June 2, 2017 |

2nd Annual Municipal Analyst Scrum: A no-holds-barred, full contact municipal analyst cage match debate |

| May 5, 2017 |

Accelerating Technological Change: Economic, Credit and Policy Implications for State and Local Governments |

| April 7, 2017 |

Mid-Terms are Just Around the Corner...Can Charter Schools Make the Grade? |

| March 3, 2017 |

Where are they now? Defaulted Municipal Credits after the Crisis |

| February 3, 2017 |

Statewide Property Tax Caps: Straightjacket or Panacea? |

| January 6, 2017 |

Ever wonder what really happened during the Detroit Bankruptcy? What was the backstory? How is the epilogue taking shape? |

| November 4, 2016 |

How will aging impact the Muni market? |

| October 14, 2016 |

The ongoing pension wars: will the smoke ever clear? |

| September 9, 2016 |

New England in New York! |

| June 13, 2016 |

The MAGNY Analyst “Scrum”: A no-holds barred, full-contact, municipal analyst cage match debate |

| May 13, 2016 |

New York City 2016-2017 Executive Budget Presentation |

| April 8, 2016 |

How 2016 Elections May Shape the Municipal Bond Policy Agenda |

| March 4, 2016 |

Credit Clusters: Is there a spill-over effect with distressed municipalities? |

| February 4, 2016 |

Drinking from a Fire Hose: how to effectively follow a vast number of municipal credits in real time with limited resources and evolving regulation |

| January 8, 2016 |

What Would a Speculative-Grade US State Look Like? |

| November 19, 2015 |

A Fiscal Bite of the Big Apple: An overview of New York City’s budget and economy |

| October 9, 2015 |

The Fiscal High-Wire Act |

| September 15, 2015 |

Higher Education: Around the Muni World in 80 Minutes! |

| June 12, 2015 |

Higher Education: State Finances at FY End 2015: Unusual Variations among States |

| May 8, 2015 |

Higher Education: Pressures on the Sector and Strategies for Dealing with Distress |

| April 7, 2015 |

Point/Counterpoint Debate: The Pros and Cons of Pension Obligation Bonds |

| March 13, 2015 |

Identifying and quantifying new approaches to finding relative value in the Municipal market |

| February 6, 2015 |

OUTLOOK? LOOK OUT. |

| January 9, 2015 |

Motown's Flipside: Plan Confirmed, Now What? |

| November 14, 2014 |

Why is U.S. Municipal Issuance Falling Despite Historically Low Interest Rates? |

| October 14, 2014 |

A Discussion on the State of New Jersey |

| September 23, 2014 |

A Discussion on the State of California |

| June 6, 2014 |

The New Fiscal Year: What's the Outlook for States? |

| May 2, 2014 |

The Affordable Care Act and the Challenges/Opportunities for Hospitals |

| April 4, 2014 |

Airports: Staying Aloft during the Storm? |

| March 7, 2014 |

Local Governments Managing Distress |

| February 7, 2014 |

How States Deal with Local Government Distress |

| January 10, 2014 |

Monitoring Local Municipal Fiscal Distress |

| November 22, 2013 |

Higher Education - Stresses and Strategies |

| October 7, 2013 |

Puerto Rico Debt |

| September 9, 2013 |

Detroit and Emergency Management in Michigan |

| June 7, 2013 |

Water Supply Issues |

| May 10, 2013 |

Puerto Rico: Economic Competitiveness |

| March 13, 2013 |

State Budget Update |

| February 15, 2013 |

Inside the New GASB Pension Standards |

| January 18, 2013 |

Impact of Hurricane Sandy on the New York/New Jersey Region |

|

Topic:

|

Federal Funding & Fiscal Futures in the Municipal Market

|

|---|

| Date: |

Wednesday, November 12, 2025

|

| Details: |

Join MAGNY for a forward-looking discussion of how U.S. fiscal federalism is adapting to new realities. Building on the "New Federalism" legacy of the 1960s to 1980s, today's system faces renewed pressure to consolidate and decentralize. Panelists will share their perspectives on how fiscal relationships are evolving across different levels of government, what these challenges mean for municipal credit, and implications for the broader municipal market. Attendees should come away with a clearer understanding of the forces reshaping intergovernmental finance and the challenges facing state and local governments as they assume greater fiscal responsibility. |

| Panelists: |

Emily Brock, Director, Government Finance Officers Association (GFOA) Federal Liaison Center

Justin Theal, Senior Officer, Fiscal 50, The Pew Charitable Trusts

Lisa Washburn, Chief Credit Officer and Managing Director, Municipal Market Analytics

|

| Moderator: |

Timothy Little, Municipal Markets Specialist, Federal Reserve Bank of New York

|

| Location: |

Zoom only

|

|

Topic:

|

The Charter School Landscape—

Current Realities and Emerging Trends

|

|---|

| Date: |

Thursday, October 23, 2025

|

| Details: |

Join us for a discussion on the evolving charter school landscape. The panel will cover the financial and regulatory factors that influence charter school education in the United States, including shifts in federal and state policies, trends in school financing, and the role of charter authorizers. Panelists will share perspectives on which environments are favorable to charter school development and where challenges persist. The conversation will also address how the expansion of school voucher programs is affecting the competitive picture for charter schools. |

| Panelists: |

Corey Callahan, General Counsel and Vice President of Policy at the New York City Charter School Center

Emily Kim, Founder & CEO of Zeta Charter Schools

Beatriz Peguero, Director, PNC Capital Markets LLC

|

| Moderator: |

Geordie Thompson, Senior VP/ Manager, Moody’s

|

| Location: |

Zoom and New York City Bar Association, 42 West 44th Street, NYC

|

|

Topic:

|

Distressed and Defaulted Credits

|

|---|

| Date: |

Thursday, September 25, 2025

|

| Details: |

Municipal bonds have long been associated with their perceived stability. Yet, economic headwinds, sector-specific disruptions, and unforeseen crises can push even municipal issuers into financial distress. Join us for an expert-led discussion on the complexities, risks, and opportunities surrounding distressed municipal bonds. Topics to be covered include how to spot and analyze signs of distress, the restructuring process, as well actionable insights and real-world perspectives on navigating distress and restructuring in the muni space. |

| Panelists: |

Naomi O'Dell, Managing Director, Raymond James

Mark Podgainy, Senior Managing Director, Getzler Henrich

Micheal Slade, Senior Vice President, UMB Bank

|

| Moderator: |

Doug Goldmacher, Vice President/Senior Analyst, Moody’s

|

| Location: |

Zoom and New York City Bar Association, 42 West 44th Street, NYC

|

|

Topic:

|

Affordable Housing

|

|---|

| Date: |

Thursday, May 15, 2025

|

| Details: |

Why is affordable housing such a hot button issue today? What are the various events from national and regional perspectives that have led us to this point? Is there any hope on the horizon for more affordable rental and ownership options? How will current federal policy affect the landscape? Hear about these issues as well as what two of the biggest issuers/lenders in the space—New York City Housing Development Corporation and Citi Community Capital—are doing to create opportunities for the construction and preservation of more quality, safe affordable housing both regionally and around the country. |

| Panelists: |

Ellen Duffy, Executive Vice President for Capital Markets and Investments, NYCHDC (biography)

Matthew Walsh, Assistant Director - Economist, Moody's Analytics (biography)

Jacob Zlotoff, Director, Securitization, Lending & Investing Group, Citi Community Capital (biography)

|

| Moderator: |

Richard Schwam, Vice President, High Yield Research Analyst, AllianceBernstein (biography)

|

| Location: |

Zoom and New York City Bar Association, 42 West 44th Street, NYC

|

|

Topic:

|

Fireside Chat with NYS Comptroller Tom DiNapoli

|

|---|

| Date: |

Thursday, April 17, 2025

|

| Details: |

Join us for an insightful conversation with New York State Comptroller Tom DiNapoli as we explore the vital roles of the State Comptroller’s Office and the economic and fiscal challenges facing New York.

This event is open to the press.

|

| Speaker: |

Tom DiNapoli, New York State Comptroller (biography)

|

| Moderator: |

Tammy Gamerman, Director, Fitch Ratings, US Public Finance - States Team (biography)

|

| Location: |

Zoom and New York City Bar Association, 42 West 44th Street, NYC

|

|

Topic:

|

Putting Tariffs in Persepctive

|

|---|

| Date: |

Wednesday, March 19, 2025

|

| Details: |

Join us for a discussion unpacking recently imposed tariffs and their impact on aspects of the municipal market such as economic growth, budgeting, supply chains and infrastructure projects. |

| Panelists: |

Dan Aschenbach, Principal Consulting Partner, AGVP Advisory (biography)

Elena Duggar, Managing Director, Chief Credit Officer – Americas, Moody's (biography)

Tom Zemetis, Director and Analytical Lead U.S. States and Transportation Team, Public Finance – The Americas, S&P Global Ratings (biography)

|

| Moderator: |

Bhanu Patil, Head of Municipal & Non-Profit Credit, Flagstar Bank (biography)

|

| Location: |

Zoom and New York City Bar Association, 42 West 44th Street, NYC

|

|

Topic:

|

Natural Disasters: The Risks to People and Places

|

|---|

| Date: |

Thursday, February 13, 2025

|

| Details: |

Issuers and investors discuss the Nation's recent natural disasters and opine on:

- the possibility of outmigration as a result of catastrophic weather events over the past year, and how that might affect community stability;

- what appetite investors have for supporting the cost of recovery, given that only federal dollars or municipal finance can approach the enormity of the problem;

- if insurers are prevented from adequately pricing risk, who will bear the cost?

|

| Panelists: |

Kim Nakahara, Senior Research Analysts and Portfolio Manager, Allspring Global Investments (biography)

Mark Schmidt, CFA, Head of Muni Strategy, Morgan Stanley (biography)

Ben Watkins, Director, Florida Division of Bond Finance (biography)

|

| Moderator: |

Casey Ryan, Credit Analyst, Invesco

|

| Location: |

Zoom only

|

|

Topic:

|

Navigating an Uncertain and Evolving Healthcare Industry

|

|---|

| Date: |

Thursday, January 16, 2025

|

| Details: |

This panel will discuss the evolving healthcare landscape and how to manage through uncertainty, particularly with a new administration. We will discuss what we are looking out for in 2025 and beyond as well as what potential policy changes could be on the horizon. The panel will also discuss current industry trends as well as challenges and opportunities. While elevated labor costs are here to stay, many providers have benefited from additional directed payments and increased commercial rates, boosting operating income. Other agenda items include cybersecurity disclosure, a potential new industry normal and strategies to strengthen organizations. The panelists will explore the present and potential future of the industry and how important it is for management teams to remain focused on executing strategies and growth during this time. |

| Panelists: |

Lisa Goldstein is a nationally recognized analyst, speaker, writer, and expert on not-for-profit healthcare. At Kaufman Hall, she is a member of the Treasury and Capital Markets practice and Thought Leadership team. Prior to joining Kaufman Hall, Lisa spent more than 30 years at Moody’s Investors Service, including 10 years serving as associate managing director. Ms. Goldstein holds an MPA in public and nonprofit finance, management and policy from the New York University Robert F. Wagner Graduate School of Public Service.

Steven Levy is a Principal and senior credit analyst for PGIM Fixed Income’s Municipal Bond Credit Research Team, focusing on high yield municipal bond issuers including not-for-profit healthcare. Prior to joining the firm in 2004, Mr. Levy was a First Vice President at Prudential Securities, concentrating on healthcare related entities. Mr. Levy has been working in public finance since 1991. He received a BA from Muhlenberg College in 1989 and an MBA in Finance from Fordham University in 1996. He is a member of the Municipal Analysts Group of New York and the National Federation of Municipal Analysts. Over his career, he has spoken at numerous healthcare related conferences on a wide range of topics. In 2014, he was named to Smith’s Municipal All-Star Team for research in high yield.

Michelle Ulrich serves as the Senior Vice President of Financial Planning & Analysis at NYU Langone Health (NYULH), helping orchestrate the financial strategy for the $14B Health System comprised of NYU Langone Hospitals and the NYU Grossman Schools of Medicine. In her role as SVP FPA, she manages the long-range financial planning, operating and capital budgeting, and financial operations for the system, which involves strategic financial modeling initiatives, evaluating debt scenarios, mergers, acquisitions, risk models, and market factors, as well as assessing the feasibility and financial viability of new capital projects. Michelle received her bachelor’s degree from New York University and her MBA from Cornell University Johnson College of Business and MS from Weill Cornell Medical College with a concentration in Healthcare Leadership, Policy and Research and has worked in the healthcare industry for over 20 years.

|

| Moderator: |

Anne Cosgrove is a Director in the not-for-profit healthcare group at S&P Global Ratings. She covers a diverse portfolio of healthcare providers across the U.S. and has a wide range of credit experience. She previously held positions at Lehman Brothers and Barclays Capital where she helped manage municipal portfolios exceeding $7 billion. Anne has an MBA in Finance and Accounting from NYU’s Stern School of Business and a BA from the University College Cork, Ireland.

|

| Location: |

Zoom and New York City Bar Association, 42 West 44th Street, NYC

|

|

Topic:

|

Election 2024 Update with Emily Brock

|

|---|

| Date: |

Thursday, November 14, 2024

|

| Details: |

Emily Brock, Director, Federal Liaison Center, GFOA discusses the results of the 2024 election and its potential impact on tax exemption in the municipal market. What will the dual challenge of deciding the future of the Tax Cuts and Jobs Act which expires at the end of 2025, and a growing federal deficit mean for continuing tax exemption of municipal bonds? Is continuance of tax exemption more vulnerable in this election cycle than it has been in past? |

| Moderator: |

Anne Ross

Principal Consultant

Muni Credit & Compliance Advisors, LLC

|

| Speaker: |

Emily Brock, Director, Federal Liaison Center, GFOA

|

| Location: |

Zoom only

|

|

Topic:

|

Energy Transition: Navigating Opportunities and Challenges

|

|---|

| Date: |

Thursday, October 10, 2024

|

| Details: |

Electric utilities across the United States are facing profound mandates directing them to sharply reduce or eliminate their power plants’ carbon dioxide emissions by supplanting thermal generation with cleaner generation resources. Federal and state mandates could fundamentally reshape how America’s utilities produce and procure electricity.

Join us for a panel that will unpack the critical themes shaping the energy transition. Industry experts will share insights into managing grid reliability, available generation and storage technologies, the costs of migrating to cleaner resources, harmonizing decarbonization with growing demand, and avenues for financing clean energy infrastructure. |

| Moderator: |

Tiffany Tribbitt, Managing Director, Head of Municipal and Cooperative Power, S&P Global Ratings

|

| Panelists: |

Adam Barsky, CFO, New York Power Authority

Ksenia Koban, Director of Fixed Income ESG Investing, Neuberger Berman

Tom Falcone, President-Elect, Large Public Power Council

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC

|

|

Topic:

|

An Inside Look at the Country's Largest Public Works Project with Gateway Development Commission CFO Pat McCoy

|

|---|

| Date: |

Wednesday, September 18, 2024

|

| Details: |

The Gateway Program’s $16 billion Hudson Tunnel Project is the country's largest and arguably most important public works project currently underway. This long-delayed initiative will build a new two-track tunnel under the Hudson River and rehabilitate an existing tunnel. In July 2024, the project received final federal approval, securing a $6.9 billion federal grant—the largest ever issued to a mass transit project.

Early construction work has begun on both sides of the river, with the new tunnel expected to be completed by 2035. This complex project involves collaboration between the states of New York and New Jersey, the federal Department of Transportation, and Amtrak. It will significantly improve the reliability, resiliency, and redundancy of the Northeast Corridor, the nation's most heavily used rail line.

Please join us for a fireside chat with Pat McCoy, Chief Financial Officer of the Gateway Development Commission (GDC) and a longtime New York public finance veteran. Pat joined the GDC in February 2023 after managing debt issuance at the Metropolitan Transportation Authority (MTA) for two decades. The GDC is a public authority created in July 2019 by the states of New York and New Jersey to oversee the planning and financing of Phase 1 of the Gateway Program.

|

| Speaker: |

Pat McCoy, Chief Financial Officer of the Gateway Development Commission (GDC)

|

| Moderator: |

Tammy Gamerman

Director, Fitch Ratings

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC

|

|

Topic:

|

You're the Bankruptcy Lawyer - Interactive Panel

|

|---|

| Date: |

Thursday, June 13, 2024

|

| Details: |

Join us for an interactive panel where audience members roleplay a part in the bankruptcy process. We’ll learn about the roles and goals of the different parties in a bankruptcy case while working through issues that arose in an actual case, involving a hospital credit.

Please join us in this participatory learning opportunity and stay for our social gathering that caps the end of MAGNY’s spring season before picking back up this September.

|

| Moderators: |

Colleen A. Murphy

Carl McCarthy

Kevin J. Walsh

Charles W. Azano

Christopher Marks

Greenberg Traurig, LLP

Speaker Bios

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC

|

|

Topic:

|

Deciphering Population Shifts, Housing Needs, and Fiscal Realities

|

|---|

| Date: |

Thursday, May 16, 2024

|

| Details: |

Over the next fifty years the Congressional Budget Office (CBO) estimates the U.S. population will grow by less than half the pace experienced since 1973. An aging populace, changes in household formation, and new workforce dynamics are among the trends impacting all sectors of the municipal market. Against this backdrop, New York City faces a perplexing problem of rising unaffordability and a declining population (according to Census figures).

The panel will explore how demographic trends impact credit quality, the housing affordability crisis, and implications for the New York City area. Audience members will come away from the discussion with a better understanding of key demographic shifts to watch, how they may impact the City’s finances, and potential policy options to address the region’s housing shortage.

Please join us and our panel of experts who will share their thoughts on these issues impacting municipal credit.

|

| Panelists: |

Alex Armlovich

Senior Housing Policy Analyst

Niskanen Center

Francesco Brindisi

Executive Deputy Comptroller for Budget and Finance

Office of the New York City Comptroller

Olu Sonola

Head of U.S. Economic Research

Fitch Ratings

|

| Moderator: |

Timothy Little

Municipal Markets and Public Finance

Federal Reserve Bank of New York

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

Navigating Evolving Business Opportunities in the Municipal Bond Market

|

|---|

| Date: |

Thursday, April 18, 2024

|

| Details: |

The panel discussion will focus on the evolving dynamics of the municipal bond market. As the industry witnesses significant changes, with larger firms stepping back from municipal underwriting and the rise of SMA & hedge fund investor participation, the panel will explore the ramifications of these shifts and identify emerging opportunities.

Join our panelists to discuss:

- How the evolving landscape is influencing various stakeholders, including issuers, investors, and underwriters;

- Impact of headline disruptions on liquidity and trading flows in the market;

- Municipal asset managers’ approaches to take advantage of changing economic conditions and industry transformations, identifying new avenues for growth and adapting investment strategies in response to market changes;

- Expectations on the long-term consequences for the municipal bond business as a result of these shifts.

|

| Panelists: |

Mikhail Foux

Managing Director, Head Municipal Research and Strategy

Barclays

James Pruskowski

Chief Investment Officer

16Rock Asset Management

Ed Tishelman

Senior Managing Director, Head of Municipal Sales & Trading

Siebert Williams Shank & Co |

| Moderator: |

Bhanu Patil

Head of Municipal Credit

Flagstar Bank

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event was available to those who registered for one week only.

|

|

Topic:

|

Understanding How Federal Decisions and Economic Conditions Impact Municipal Bond Markets

|

|---|

| Date: |

Thursday, March 14, 2024

|

| Details: |

"History doesn't repeat itself, but it often rhymes."

This panel will explore key federal and macroeconomic influences on municipal bond markets in 2024. Municipal bonds were the best performing fixed income asset class in 2023, with solid total returns powered by a remarkable bond rally in late 2023.

However, near-term uncertainties persist which lends caution to issuer and investor sentiment. Market expectations for rate cuts in 2024 deviate from the official Federal Reserve narrative and mixed economic data complicates the near-term rate outlook. Federal legislative actions in a highly charged political landscape and impending elections present both risks and opportunities. Sequestration-driven extraordinary redemptions for BABs are back in focus for issuers. Credit fundamentals, resilient in recent years, will be tested in a slowing economic environment, with waning federal aid.

Join our panelists to discuss and highlight their expertise on:

• Near-term rate expectations underpinned by macroeconomic forces, both domestic and global;

• Supply side municipal market dynamics and assessing the trajectory of fund flows;

• Identifying pockets of relative value at a time of stretched valuations; and

• Prognosis for default/distress, highlighting the more vulnerable segments of the market.

This event is open to the press.

|

| Panelists: |

Amanda Del Bene

Public Finance Investment Banking

Raymond James & Associates, Inc

New York

Thomas G. Doe

President

Municipal Market Analytics, Inc. (MMA)

New York

Atsi Sheth

Managing Director Credit Strategy

Moody's Investors Service

New York

|

| Moderator: |

Vikram Rai

Head of Municipal Market Strategy

Wells Fargo

New York

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

Technology: Another Tool in an Analyst's Toolbox

|

|---|

| Date: |

Thursday, February 15, 2024

|

| Details: |

The panel will explore service enhancements that new technologies including AI can offer and the expected impacts on the municipal bond market. Technology is being utilized to enhance communication, improve portfolios management thorough timely and effective credit monitoring. This will allow investors to make more informed decisions that meet their investment strategies. However, as firms begin to incorporate new approaches including AI into their services, it is critical to understand the Strengths, Weaknesses, Opportunities and Threats (SWOT) in order to optimize the potential of this technology in meaningful and productive ways.

This event is open to the press.

|

| Panelists: |

Chris Fenske

Head of Capital Markets Research

S&P Global Market Intelligence

Susan Joyce

Head of Municipals Trading & FI Market Structure

Alliance Bernstein

William Kim

Chief Executive Officer

MuniPro

|

| Moderator: |

Casey Ryan

Credit Analyst

Invesco

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

Changing the Garden State:

A Fireside Chat with New Jersey Governor Phil Murphy

|

|---|

| Date: |

Thursday, January 18, 2024

|

| Details: |

In early 2020, New Jersey's budget forecasters envisioned catastrophic revenue shortfalls as the US economy contracted sharply due to the strains of a once-in-a-century pandemic. The state had seemingly been on a slow road to fiscal recovery in 2018-19 until the pandemic derailed those plans, resulting in a short-term cash crunch and credit rating downgrades. Three years later, the picture is very different. The Garden State has accumulated its highest fiscal reserve balances since the mid-1990s, begun covering full actuarial payments on its pensions, and received seven credit rating upgrades. The state appears to be on a new fiscal trajectory. How did this happen, and where is NJ headed?

Please join us for a fireside chat with the Honorable Phil Murphy, New Jersey's governor and a veteran of the finance industry. Governor Murphy spent 23 years working in the financial markets, nearly all of it at Goldman Sachs. During his tenure at Goldman Sachs, Murphy headed the firm's Frankfurt office from 1993 to 1997 and Goldman Sachs Asia from 1997 to 1999, and was a member of the firm's senior management committee from 1999 to 2003. Murphy later served as the U.S. ambassador to Germany from 2009 to 2013 in the Obama Administration. He was elected governor of New Jersey in 2017 and won a second term in 2021, the first Democrat to do so since 1977.

In our conversation with Governor Murphy, we will wade deeply into the strategies pursued by his administration to stabilize New Jersey's long-term liability position, pay down debt, strengthen its finances, and promote budgetary sustainability, including by ramping up payments for the actuarially-determined contributions (ADCs) for New Jersey's public sector pension plans.

This event is open to the press.

|

| Moderator: |

Neene Jenkins

Executive Director

JP Morgan Chase Asset Management

Neene Jenkins is a member of the Global Fixed Income, Currency & Commodities (GFICC) group at JP Morgan Chase Asset Management. Based in New York, Neene leads municipal research efforts supporting Tax Aware strategies. Neene is also responsible for identifying investment opportunities in the High Yield and Investment Grade sectors. Prior to joining the firm in 2019, she was a senior vice president at Alliance Bernstein for 9 years, covering Municipal High Yield and Investment Grade sectors. Neene holds a B.A. in applied mathematics from the University of Buffalo and an MPA in public finance from the New York University's Robert F. Wagner School of Public Service, where she was also an adjunct professor. She is a member of the Society of Municipal Analysts, Former Chair of the Education Committee and of DEI Committee for the National Federation of Municipal Analysts (NFMA), currently Vice Chair of NFMA and a board member of the Northeast Women in Public Finance.

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

Back on Track - What's Ahead for the MTA in 2024 and Beyond

|

|---|

| Date: |

Monday, November 13, 2023

|

| Details: |

Less than a year ago, the Metropolitan Transportation Authority (MTA) warned of recurring $3 billion operating deficits after federal pandemic relief ran out and ridership patterns failed to return to pre-pandemic levels. Recent New York State legislative action averted the looming crisis, completely eliminating projected deficits in the MTA’s most recent financial plan, an unprecedented turn of events. With the operating budget settled, the MTA can pivot to its $55 billion capital plan for 2020-2024, including one of the centerpieces of its capital funding plan, congestion pricing.

Please join us for a fireside chat with Kevin Willens, the MTA's Chief Financial Officer and public finance veteran. Kevin has more than 35 years in public finance, including most recently as Managing Director and Co-head of US Public Finance at Goldman Sachs and 10 years as the MTA's financial advisor.

We will take a deep dive into the assumptions and risks underlying the MTA's operating budget and discuss the authority's capital plans including its upcoming implementation of congestion pricing in 2024.

This event is open to the press.

|

| Moderators: |

Chandra Ghosal, Vice President - Senior Analyst

Moody's Investors Service, US Public Finance Group

Tammy Gamerman, Director

Fitch Ratings, US Public Finance - States Team

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

Rural Hospitals and Life Plan Communities: Predicaments and Opportunities Confronting the Muni Market's Two Most Pressured Sectors

|

|---|

| Date: |

Tuesday, October 31, 2023

|

| Details: |

Recent reports contain dire predictions of the potential closure of nearly a third of U.S rural hospitals in 2023 and 2024 due to their pressured finances as federal stimulus dollars recede. Meanwhile, the related and almost-equally-pressured sector of life plan communities (aka CCRCs) continues to grapple with inflationary cost pressures, acute labor shortages, and the ramifications of a softer housing market.

There has been a growing trend of acquisitions of rural hospitals by private equity firms that have, in some cases, acted quickly to shutter the hospitals they have purchased, as well as an uptick in CCRC acquisitions and affiliations. Default rates for both sectors far exceed broader municipal market averages.

Join our panelists to highlight their diverse and unique perspectives on:

- The key forces underpinning these sectors' operational challenges and how the pandemic greatly amplified staffing and cost pressures

- Can these sectors recover in the near term? And, what would be the 'new normal' for these providers in a stabilizing economy?

- What strategies can industry executives and (state and local?) policymakers adopt to aid their operations and ensure access to critical healthcare needs for communities served?

- Key dynamics for the institutional investor base in evaluating, pricing, and trading bonds issued by these entities, many of which are speculative grade and/or non-rated.

|

| Panelists: |

Kevin Neuman, Principal

Novo Advisors

Biography

Gary Sokolow, Director

Fitch Ratings Healthcare and Life Plan Communities Team

Biography

Jeff Sommer, Managing Director

Stroudwater Associates Rural Healthcare Practice Group

Biography |

| Moderator: |

George Huang

Biography

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

2024 Municipal Bond Outlook – Rising Rates Making Issuers Irate, While Investors Elate

|

|---|

| Date: |

Thursday, September 7, 2023

|

| Details: |

As the new year rapidly approaches, municipal bond investors are working around the clock to determine which credits and where on the yield curve to invest capital in 2024 based on their data driven assessments of fundamental and technical factors. Higher bond yields will create a disproportional stress across issuers but bode well for demand across the fixed income sector. The combination of the slower than expected return to the office, the presidential election, and a sharp decline in post-COVID consumer spending will create significant uncertainty for both issuers and investors alike. Please join us and our panel of experts, moderated by Stephen Winterstein, who will share their thoughts from an investment banker, investor, and strategist perspective. |

| Panelists: |

Kristin Stephens, Managing Director, Head of Credit Strategies

UBS Financial Services, Inc.

Biography

Vikram Rai, Municipal Strategist

Biography

Mark Schmidt, Head of Municipal Strategy

Morgan Stanley

Biography |

| Moderator: |

Stephen Winterstein, Managing Partner

SP Winterstein & Associates, LLC

|

| Location: |

NYC Bar Association and Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

Fourth Annual Analyst Scrum and Cocktail Party - The Career Remix Edition

|

|---|

| Date: |

Thursday, June 8, 2023

|

| Details: |

A conversation around muni market careers. You can ask about any career topic you wish to introduce to a team of “career subject matter experts” - the Scrum Leaders. The end-of-season cocktail party will give attendees the chance to catch up with friends, discuss issues of common interest and engage in a spirited debate, all in a single event. |

| Subject Matter Experts: |

Anne Cosgrove

Director, Lead Analyst, S&P

Matt Fabian

Partner, Municipal Markets Analytics, Inc.

Neene Jenkins

Head of Municipal Research, JP Morgan Asset Management

Amy Laskey

Retired credit analyst with multiple years of public/private sector experience. |

| Scrum Master: |

Mary Francoeur

Managing Director, PFM Financial Advisors LLC

|

| Location: |

NYC Bar Association

This event was not recorded.

|

|

Topic:

|

Water Security in a Changing Environment

|

|---|

| Date: |

Thursday, May 25, 2023

|

| Details: |

Increased hydrological volatility has altered the landscape for western region water suppliers. Despite favorable 2023 conditions thus far, the Colorado River remains stressed, prompting potential unprecedented federal actions. This panel will explore potential water right resolutions and what the outcome could mean for water supply in California, Arizona, and Nevada. How will potentially shifting water allocations affect public finance credits in the region and how are highly rated managers responding? |

| Panelists: |

Bill Hasencamp (BIO)

Manager, Colorado River Resources

Metropolitan Water District of Southern California

Christopher H. Hall (BIO)

Assistant General Manager, Finance and Administration

Central Arizona Project

Colby N. Pellegrino (BIO)

Deputy General Manager of Resources

Southern Nevada Water Authority |

| Moderator: |

Jenny Poree (BIO)

Senior Director, Sector Leader Utility Revenue

S&P Global Ratings

|

| Location: |

Zoom only.

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

Investing in Social Impact: A New Frontier of Muni Analysis

|

|---|

| Date: |

Thursday, April 20, 2023

|

| Details: |

As investors increasingly seek to align their portfolios with their values, social impact analysis is becoming a fundamental component of investment decision making tailored to individual client needs. Munis are not only a source of stability in any portfolio, but an opportunity to drive positive social change in communities across the country. Our panel of experts will discuss the changing landscape of credit analysis to accommodate this growing trend among investors, what matters to investors and analysts, and its effect on the market. We will also consider challenges in addressing social impact investment directives and what this means for the future of munis. |

| Panelists: |

Lourdes Germán

Executive Director

The Public Finance Initiative

Clyde Lane, Jr.

Municipal Credit Analyst

Ramirez Asset Management

Emily Thomas, CFA

Head of Investing with Impact

Morgan Stanley Wealth Management

|

| Moderator: |

Timothy Little

Municipal Markets Specialist

Federal Reserve Bank of New York

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

Higher Education: Moving Forward after the Pandemic

|

|---|

| Date: |

Thursday, March 23, 2023

|

| Details: |

COVID completely disrupted the higher education model for most 4-year institutions, between campus closures, remote learning, technology implementation, and operational adjustments. For schools that were already experiencing enrollment declines and tight operating margins, COVID compounded the pressure in many cases. During this panel we will discuss what the operating horizon looks like, how schools are adapting (or not), and what bondholders should be on the lookout for in distressed situations. |

| Panelists: |

George M. Edwards-Stimola, Director, Fitch Higher Ed/Non-Profits

Pam Salmon, Vice President for Financial Affairs and Treasurer, Utica University

Chad Shandler, Senior Managing Director, FTI Consulting

|

| Moderator: |

Lindsay Wilhelm, Senior Municipal Credit Analyst, Raymond James Capital Markets

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

Trends and Challenges in Charter School Bond Financings

|

|---|

| Date: |

Thursday, February 16, 2023 |

| Details: |

A panel discussion on tax-exempt bond financing for charter schools, with a particular focus on distressed and workout situations. Panel participants are capital markets experts, including charter school bond purchasers, attorneys, and rating agency analysts. We will discuss typical terms of charter school bond financings, recent issuance volumes and characteristics, and bond security structures & covenants. We will also consider challenges faced by charter school investors, especially in the non-rated and high-yield end of the rating spectrum. |

| Panelists: |

Seth Klempner, Director, Rosemawr

Thomas Longino, Founder, Longino Public Finance LLC

Shivani Singh, Director and Lead Analyst, NY, S&P Global Ratings

|

| Moderator: |

Carl McCarthy, Of Counsel, Greenberg Traurig, LLP

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

The Future of Cities

|

|---|

| Date: |

Wednesday, January 25, 2023 |

| Details: |

Increased digitalization and a movement toward hybrid work are changing the way we live, work and play in cities. As cities become smarter and urbanization increases, how are cities adapting to these changes? How is technology allowing for the delivery of better and more efficient services? How does infrastructure need to change? Join us to discuss these topics and more. |

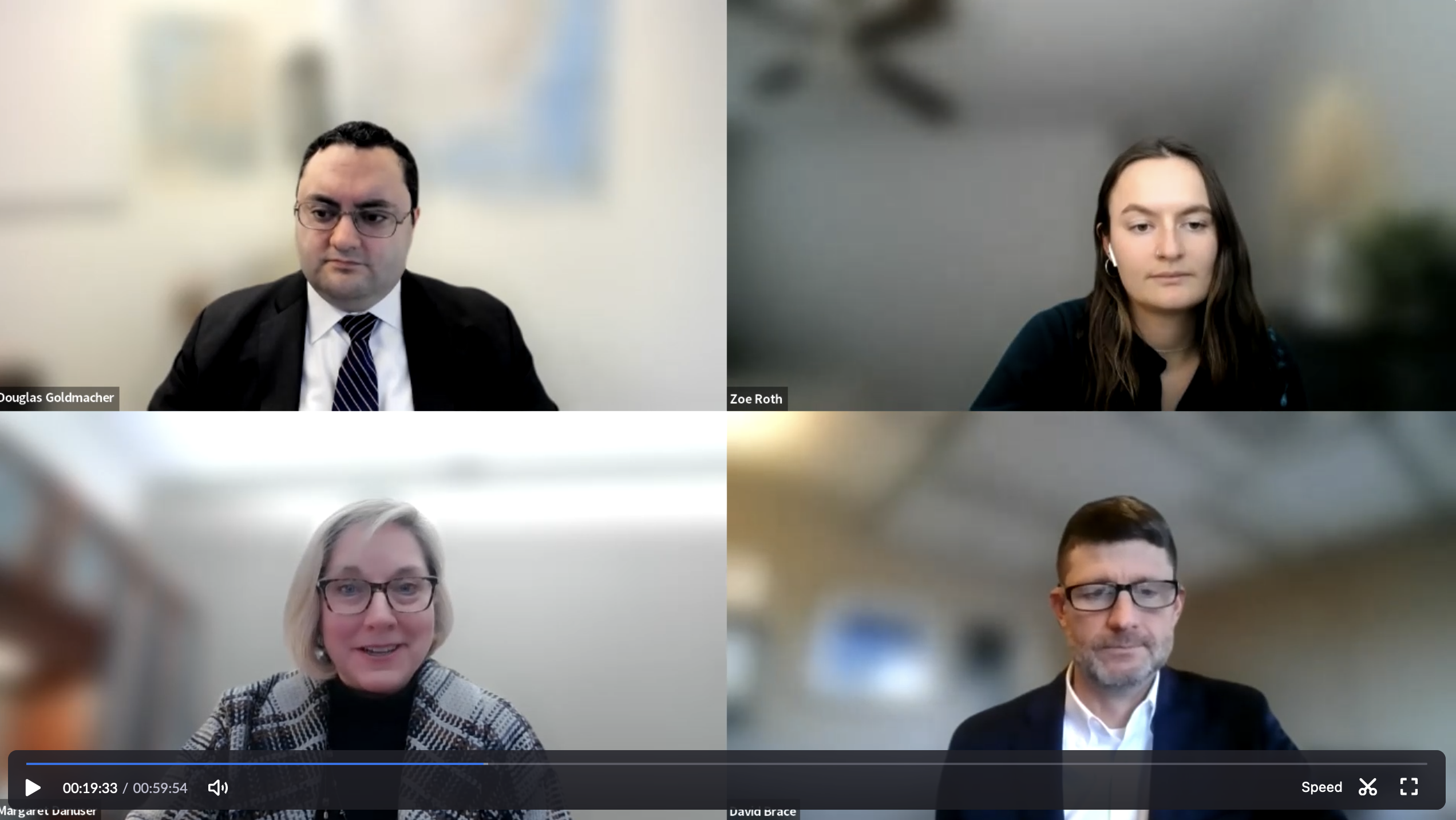

| Panelists: |

David Brace, Deputy to the Mayor & COO, City of Knoxville, TN

Margaret Danuser, Chief Financial Officer, City and County of Denver, CO

Zoe Roth, Research Associate, Internet of Things, S&P Global Market Intelligence

|

| Moderator: |

Douglas Goldmacher, Vice President-Senior Analyst, Public Finance Group, Moody’s Investors Service

|

| Location: |

Zoom

The recording of this event is available to those who registered for one week only.

|

|

Topic:

|

What will the Midterm Election Results Mean for Federal Policy?

|

|---|

| Date: |

Wednesday, November 30, 2022 |

| Details: |

The party in the White House tends to lose seats in mid-term elections. By the time November 30th rolls around we will know which party controls the House and the Senate. Should a divided government ensue as many expect, what does that mean for Federal Policy such as the Inflation Reduction Act? What about the outcome of the races for governor and state legislatures? What might the election results mean for key sectors in the municipal finance market? Our panelists will provide insights into what to expect as policy decisions play out in 2023 and 2024. |

| Panelists: |

Emily S. Brock - Director, Federal Liaison Center - GFOA

Dillon Gibbons - Policy Director - NAST

William Glasgall - Senior Director, Public Finance - The Volcker Alliance

|

| Moderator: |

Anne Ross - Principal Consultant - Muni Credit & Compliance Advisors LLC

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only. |

|

Topic:

|

Healthcare Strategy During Uncertain Times – Paving the Way for Success

|

|---|

| Date: |

Thursday, October 13, 2022 |

| Details: |

Please join MAGNY's discussion regarding the U.S. not-for-profit healthcare industry and its ability to maintain profitability and growth in a challenging, uncertain environment with high inflationary and labor costs as well as growing recession risks. The panelists will explore the present and potential future of the industry and how important it is for management teams to remain focused on executing strategies and growth during this time. The panel will address the potential impacts of new competitors, the evolving healthcare model and key ingredients to success. |

| Panelists: |

Palmira M. Cataliotti

SVP of Finance Operations & Accounting

NYU Langone Health

Richard Miller

Executive Vice President and Chief Business Strategy Officer

Northwell Health

David Stephan

Executive Director

J.P. Morgan NFP Healthcare Group

|

| Moderator: |

Anne Cosgrove

Director

S&P Global’s not-for-profit healthcare

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only. |

|

Topic:

|

Navigating U.S. Economic Stresses: Can Munis Maintain Stability in a High-Inflation Environment?

|

|---|

| Date: |

Thursday, September 15, 2022 |

| Details: |

MAGNY held a discussion regarding the U.S. Municipal Bond Market and its ability to maintain stability in an environment characterized by high inflation and growing recession risks. The panelists explored the past, present and potential future of the muni market during eras marked by severe macroeconomic challenges and discuss their near-term expectations for issuance, demand and performance vis-à-vis other market sectors. The panel addressed the potential impacts on the market of sustained high inflation and restrictive Fed policies coupled with persistent supply chain and labor cost pressures. |

| Panelists: |

Vikram Rai

Managing Director, Fixed Income Strategy Group

Citigroup

Olu Sonola

Head of U.S. Regional Economics

Fitch Ratings

|

| Moderator: |

Shannon McCue

Senior Director, Public Finance

Fitch Ratings

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

The recording of this event is available to those who registered for one week only. |

|

Topic:

|

NYC Mega Projects Update

|

|---|

| Date: |

Thursday, June 23, 2022 |

| Details: |

MAGNY's New York City "Mega Projects" event will provide updates on some of the city’s largest infrastructure projects, including redevelopment of Newark and LaGuardia airports, project financing, and implications for the region. |

| Panelists: |

Elizabeth “Libby” McCarthy

Chief Financial Officer

The Port Authority of New York and New Jersey

Mary Francoeur

Managing Director

PFM Financial Advisors, LLC.

Patrick McCoy

Deputy Chief, Financial Services

Metropolitan Transportation Authority

|

| Moderator: |

Timothy Little

Municipal Markets Specialist

Federal Reserve Bank of New York

The views expressed by the speaker are their own and do not necessarily represent those of the Federal Reserve Bank of New York or the Federal Reserve System.

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

This event was not recorded. |

|

Topic:

|

Solving the Affordable Housing Crisis:

Evaluating Challenges and Opportunities

|

|---|

| Date: |

Wednesday, May 11, 2022 |

| Details: |

Politicians and market participants want to solve the affordable housing crisis but it’s complicated. Join experts from the various players in affordable housing for a robust conversation about what’s happening, and hear insights on their evaluations of new programs and Incentives. We’ll cover:

* How scalable are various local housing projects/incentives

* ESG impacts of building affordable housing

* Funding sources for design, development and building of affordable housing

* And more! |

| Panelists: |

Julie Egan bio

Director of Research & Portfolio Management

Community Capital Management

Geoff Proulx bio

Managing Director and Co-Head of the Affordable Housing and Community Development Group

Morgan Stanley

Gary Rodney bio

Managing Director, Head of Affordable Housing

Tishman Speyer

|

| Moderator: |

Marian Zucker bio

Housing Sector Leader

S&P Global

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

This event was not recorded. |

|

Topic:

|

Decarbonization of Transportation and Power Utilities

|

|---|

| Date: |

Wednesday, April 20, 2022 |

| Details: |

During the COP26 Climate Summit in 2021, the United States made an ambitious commitment to reach 100% renewable electricity generation by 2035 and to work with other leading carbon-emitting countries to reduce methane emissions, develop carbon capture, utilization, storage, and direct air capture technologies. As U.S. climate representatives and federal agencies work on developing domestic pathways to achieve these targets, they will likely find it necessary to pivot from historically carbon-intensive industries and aim to achieve economic output without reliance on an abundant and reliable supply of fossil fuels.

Transportation Entities and Power Utilities are two of the most affected industries from energy transition. We talk to experts in these industries about how these policy initiatives are affecting operations, what type of solutions exist to help manage the risk and specifically how the Long Island Power Authority is working to achieve not only federal, but state level requirements toward decarbonization.

|

| Panelists: |

Dan Aschenbach

President, AGVP Advisory

Rick Shansky

Senior Vice President of Power Supply and Wholesale Markets, Long Island Power Authority

Derek Utter

Chief Development Officer, Port Authority of New York and New Jersey |

| Moderator: |

Nora Wittstruck

Senior Director – ESG Sector Leader, U.S. Public Finance, S&P Global

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

This event was not recorded. |

|

Topic:

|

Mass Transportation after the Pandemic

|

|---|

| Date: |

Wednesday, March 23, 2022 |

| Details: |

Mass transportation was immediately and severely affected by the COVID-19 pandemic. Public transits systems were significantly impacted by drastic drops in ridership due to business closures, event cancellations, and social distancing regulations, that reduced the ability to generate revenue. Federal Stimulus provided a necessary lifeline by offsetting the immediate revenue losses but challenges remain. Please join us to discuss the post-pandemic challenges and potential solutions that ensure public transit systems remain financially viable after the stimulus funds are exhausted.

|

| Panelists: |

Martha R. Behan

Assistant Treasurer, Southeastern Pennsylvania Transportation Authority

William Viqueira

CFO & Treasurer, New Jersey Transit Corporation

|

| Moderator: |

Baye Larsen

Vice President/Senior Credit Officer, Moody's Investors Service

|

| Location: |

New York City Bar Association, 42 West 44th Street, NYC AND on Zoom

This event was not recorded. |

|

Topic:

|

Webinar: Will the structural shifts in the commercial real estate market catalyzed by COVID-19 permanently impact municipal tax revenues?

|

|---|

| Date: |

Wednesday, February 16, 2022 |

| Details: |

Commercial real estate (CRE) provides an essential foundation for tax revenue generation. Moreover, as an economic base of commerce, industry, and entertainment, it serves to concentrate consumers, colleagues, and intellectuals to optimize growth and innovation. However, that same utility is an Achilles heel during times of plague, as limiting access to infrastructure that draws large numbers of people together is necessary to slow the spread of pathogens like COVID-19.

Predicting the long term financial impact on municipalities and industries has been particularly challenging with COVID-19, as it is the first global pandemic to occur during the age of the internet, where for the first time in history a large segment of workers were able to effectively perform their functions remotely from the safety of their home and almost every type of purchase could be made online without stepping into a store. This decentralization of workers and consumers has already had a profoundly negative impact on hospitality, small businesses, and brick and mortar retail that has been slow to recover regardless of geography. The new dynamic could drive significant changes in the essential revenue streams that commercial properties provide to state and local governments if just some of these tactical behaviors become permanent.

The pandemic will likely drive some permanent changes in the US commercial real estate landscape that will have positive financial implications for certain municipalities, while lowering revenue for others. How is the current state of the CRE market impacting real estate tax assessments and collections? Which COVID-19 related impacts to the CRE market are temporary and which are more likely to be permanent? Which geographies are the early beneficiaries of the changes in the CRE market post-COVID-19? |

| Panelists: |

Gay (Scholastica) Cororaton, Senior Economist, National Association of Realtors

Ms. Cororaton is a Senior Economist and the Director of Housing & Commercial Research with the Research Group of the National Association of REALTORS®. She manages the production of NAR’s proprietary housing, commercial, and international statistics, surveys, and research. Her research focuses on the effect of economic, demographic, and industry conditions on the current trends and outlook in the residential and commercial property markets.

Manish Rajguru, Commercial Mortgage Backed Securities Portfolio Manager, OFS Capital Management

Mr. Rajguru is a Director of OFS Capital Management, LLC, and is responsible for Commercial Backed Securities (CMBS) and Commercial Real Estate (CRE) liquid credit investing of the Structured Credit Group. Mr. Rajguru has more than 20 years of experience in the credit industry. Prior to joining OFS Capital Management in 2020, Mr. Rajguru held positions at Lord Abbett as a Portfolio Manager for the firm’s taxable fixed-income strategies; a CMBS Portfolio Manager at Guggenheim Partners Investment Management; Head of Commercial Real Estate Valuations at Houlihan Lokey/Red Pine Advisors; a CMBS Portfolio Manager at UBS; a CMBS Research Analyst at Credit Suisse; and earlier in his career worked on CMBS Securitization/Surveillance groups at Lehman Brothers. Mr. Rajguru earned a Bachelor of Science in finance from Northeastern University and a Master of Business Administration in finance from New York University’s Leonard N. Stern School of Business. From October 2015 until May 2020 Mr. Rajguru was the Chair of the CMBS Council of the Association of Institutional Investors.

George Sweeting, Acting Director, NYC Independent Budget Office

Mr. Sweeting is NYC Independent Budget Office’s (IBO) acting director and supervises our research, analysis, and projections. He joined IBO in August 1996, its first year of operations, as a senior economist covering the real property tax. Prior to IBO, George worked for 10 years at the city’s Department of Finance in the Office of Tax Policy analyzing the city’s income taxes (business and personal), and later, the Property Division, where he was responsible for policy analysis and quality control of the real property tax. He also served on the staff of the 1987 New York City Tax Study Commission and the 1993 Real Property Tax Reform Commission. George is a one-time hockey player and life-long fan of the New York Rangers. He received both his Ph.D. in economic history and B.A. from Columbia University. |

| Moderator: |

Chris Fenske, Head of Capital Markets Research – Global Markets Group, IHS Markit |

| Location: |

Zoom Webinar - this event was closed to the press and was not recorded |

|

Topic:

|

Webinar: Efficient or Overwhelming: How is Enhanced Data and Analytics Driving Municipal Analysis?

|

|---|

| Date: |

Friday, January 21, 2022 |

| Details: |

We hope that better data availability enhances our analysis, especially when evaluating ESG and other emerging risks, but are we getting lost in the trees? Join us for a panel featuring market participants to discuss how analysts use data to generate alpha and simplify analysis. Panelists will also discuss the troubles brought on by ingesting too much data, and how we can streamline processes so that risk doesn’t get lost in the numbers. |

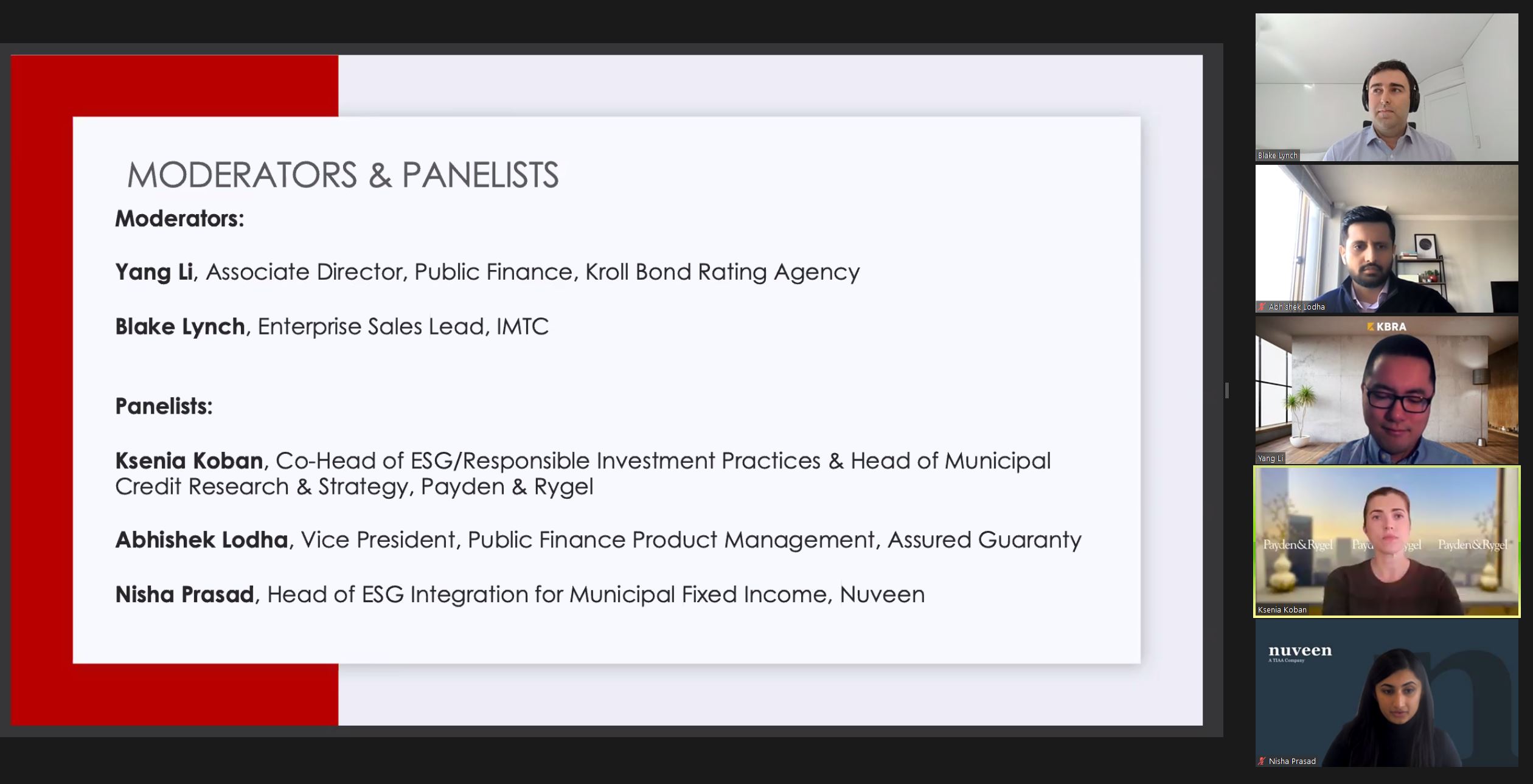

| Panelists: |

Ksenia Koban, Co-Head of ESG/Responsible Investment Practices & Head of Municipal Credit Research & Strategy, Payden & Rygel

Abhishek Lodha, Vice President, Public Finance Product Management, Assured Guaranty

Nisha Prasad, Head of ESG Integration for Municipal Fixed Income, Nuveen |

| Moderators: |

Yang Li, Associate Director, Public Finance, Kroll Bond Rating Agency

Blake Lynch, Enterprise Sales Lead, IMTC |

|

| Location: |

Zoom Webinar - Recording Available to NFMA Members only |

|

Topic:

|

Webinar: Meeting the Climate Challenge: Credit Risks to Munis

|

|---|

| Date: |

Friday, November 12, 2021 |

| Details: |

Climate change is challenging analysts by posing structural changes to credit risk. Moreover, climate provisions in Federal legislative efforts have been weakened, making the US’s Paris accord promises more challenging. With that backdrop, what climate leadership should we expect from the states to step up to achieve the needed 50% emission cuts by 2030? What credit implications would decarbonization mean for state and local governments and public power? What can be expected in the clean energy transition? Where are the economic opportunities? Given the materiality of climate change risks, what are the credit metrics and disclosures necessary to assess such risks? These and other issues will be addressed by this highly accomplished and esteemed panel. |

| Panelists: |

John Larsen

Director, Head of US Power and Energy Systems Research

Rhodium Group

Former Governor Bill Ritter

Director, Center for the New Energy Economy

Colorado State University

Emily Robare

Vice President/Muni ESG Lead

PIMCO |

| Moderators: |

Patricia McGuigan

Anne Ross

Principal Consultant

Muni Credit & Compliance Advisors LLC |

| Location: |

Zoom Webinar - Recording Available to NFMA Members only |

|

Topic:

|

Webinar: New York City: Will a New Mayor Mean a New Future?

|

|---|

| Date: |

Friday, October 8, 2021 |

| Details: |

The Fall Season kicks off for MAGNY, and the mayoral election. While few things are guaranteed in modern politics, a new administration, and a new approach to running the city, is perhaps the closest one can get to such a thing. Will the coming administration be able to right the ship on the challenges of the past several years, or are we on an irrevocable reversion to being “That 70’s City”? What about the City’s economic and financial prospects? Will the influx of billions in federal funding provide the means to make the investments necessary to springboard New York into post-pandemic prosperity, or merely serve to delay making tough fiscal decisions?

Our panelists will provide a unique perspective on what a changing of the guard means for the City’s emergence from the pandemic and overall future. |

| Panelists: |

David Womack

Deputy Director, Financing Policy & Coordination

New York City Office of Management & Budget

Andrew Rein

President

Citizens Budget Commission

John Ceffalio

Senior Research Analyst, Municipals

CreditSights

Adjunct Professor

New York University

Graduate School of Public Service |

| Moderator: |

Clyde Lane, Jr.

Municipal Credit Analyst

Ramirez Asset Management |

| Location: |

Zoom Webinar - Recording Available to NFMA Members only |

|

Topic:

|

Webinar: Municipal Cybersecurity Risks: Cybersecurity Insights from Issuers - perspectives and challenges with viewpoints from healthcare, utilities and local government sectors

|

|---|

| Date: |

Friday, June 11, 2021 |

| Details: |

As recent high profile cyberattacks show, security breaches continue to disrupt operations across all sectors. How do issuers protect critical infrastructure from cyberattacks? What type of investments should be made as attacks become more sophisticated and the frequency of attacks increases? Does the increasing integration of technology and operations in a post-COVID world increase risk to issuers? How does an organization recover from an attack if compromised?

Our panelists will provide insights on how issuers are working to prevent cyber breaches, and what they’ve learned from recent attacks. Additionally, they will discuss unique security challenges and vulnerabilities as they look to the future, given increased reliance on technology as a result of the COVID-19 pandemic.

|

| Panelists: |

Adam Barsky

EVP and Chief Financial Officer

New York Power Authority

Sarah Cunningham

Director

Summit Consulting (former Chief Financial Officer of Mecklenburg County, NC)

Dr. Joel Klein

SVP and Chief Information Officer

University of Maryland Medical System

|

| Moderator: |

Matt Cahill

Analyst

Moody’s Investors Service

|

| Location: |

Zoom Webinar - Recording Available to NFMA Members only |

|

Topic:

|

Webinar: Preparing for the Next Rainy Day: How will States Plan for the Next Economic Downturn?

|

|---|

| Date: |

Friday, May 21, 2021 |

| Details: |

US states have seen unprecedented financial shocks during the pandemic and have benefited from extraordinary federal aid and stimulus. Have rainy day funds played a significant part in helping US states navigate through the unprecedented financial shocks and extraordinary federal aid and stimulus of the last recession? Were they sized properly going into the recession? Does the recession hold lessons on sizing rainy day funds going forward?

Our panelists will provide insights on how states managed through the current crisis and what lessons they have learned to address future shocks. Shelby Kearns, executive director of NASBO, will discuss how states performed through the pandemic, while Phil Dean, Utah’s recent budget director, will discuss best practices for sizing state reserves for potential future budget shocks.

|

| Panelists: |

Shelby Kerns

Executive Director

National Association of State Budget Officers

Phil Dean

Public Finance Senior Research Fellow

Kem C. Gardner Policy Institute - David Eccles School Of Business |

| Moderator: |

David Hitchcock

Senior Director

S&P Global Ratings |

| Location: |

Zoom Webinar - Recording Available to NFMA Members only |

|

Topic:

|

Webinar: New York City: Moving Past the Pandemic

|

|---|

| Date: |

Friday, April 23, 2021 |

| Details: |

New York City spent April 2020 as the national epicenter of the COVID-19 pandemic. Now, a year later, new variants and uneven vaccine progress present new challenges. Public health challenges remain, as companies navigate returning to in-office work. What does this mean for the financial well-being of the city and the MTA?

Our panelists will provide insights on how health challenges, trends in the commercial real estate market, and changes to the local economy will affect New York City as we move past the pandemic.

|

| Panelists: |

Victor Calanog

Head of Commercial Real Estate Economics, Moody’s Analytics

Rahul Jain

Deputy Comptroller, New York State

Matthew Siegler

Senior Vice President for Managed Care, NYC Health + Hospitals

|

| Moderator: |

Tiffany Tribbitt

Director, S&P Global Ratings |

| Location: |

Zoom Webinar - Recording Available to NFMA Members only |

|

Topic:

|

Webinar: Tri-State Transportation: A Conversation with the Port Authority of New York and New Jersey and Regional Plan Association

|

|---|

| Date: |

Friday, March 26, 2021 |

| Details: |

The pandemic has dramatically affected the nation’s transportation network and nowhere is this more visible than the tri-state and greater New York City area. Business and leisure travel have been upended, people are working and learning from home, and mitigating health and safety risks has changed the way transportation agencies operate. As the region recovers from the pandemic that began over a year ago, it faces new challenges and opportunities. Home to 23 million residents across 13 thousand square miles, the transportation network is “the backbone of the region’s economy” and essential for everyone’s quality of life.

Our panelists will provide a local and regional perspective on how the pandemic has affected the region’s transportation network and their thoughts on the challenges and opportunities ahead.

|

| Panelists: |

Elizabeth M. “Libby” McCarthy

Chief Financial Officer

Port Authority of New York and New Jersey

Christopher Jones

Senior Vice President & Chief Planner

Regional Plan Association |

| Moderator: |

Timothy Little

Director and Lead Analyst

S&P Global Ratings |

| Location: |

Zoom Webinar - Recording Available to NFMA Members only |

|

Topic:

|

Webinar: Water: Navigating the Waves of Policy, Regulation and Coronavirus

|

|---|

| Date: |

Friday, February 26, 2021 |

| Details: |

Water-related utilities are critical components of the nation's health and economic stability. However, utilities are wrestling with maintaining service quality while ensuring accessibility and affordability. What are the risks to the sector from coronavirus and how can the sector overcome them to achieve its mission? Is the regulatory process adequately addressing the concerns in protecting America's waters? What policies at the federal level are being discussed and how might these policies impact the industry? How is the federal government supporting the industry financially to ensure its success?

Our panelists will provide their perspectives on these questions facing the industry.

|

| Panelists: |

Kareem Adeem, Director, City of Newark, New Jersey Department of Water & Sewer Utilities.

Director Adeem is a Newark native who began working for the City of Newark in 1991 in the Department of Engineering and has moved up the ladder in his field. In 2013, Director Adeem was promoted to Superintendent of Public Works, where he oversaw daily maintenance operations of the Department of Water & Sewer Utilities. He was promoted Assist Director in 2016, and Acting Director position in 2018.

Director Adeem will receive his Bachelor’s Degree in Construction Management from Thomas Edison University in 2021. In 2018 he received his certification as a Public Works Manager and in 2015 he received his certification as a Public Manager from Rutgers University. Adeem is also a National Certified Storm Sewer Inspector, National Association of Sewer Service Companies (NASSCO), Certified Pipeline Assessment & Certification Program (PACP), and Manhole Assessment & Certification Program (MACP) Sewer Inspector, and holds a NJ DEP Water & Waste Water Operators license.

He was a key player in various municipal projects, including the Queen Ditch Restoration Project, which helped address chronic flooding along Frelinghuysen Avenue that has plagued the area for more than 30 years.

Currently, Director Adeem is credited with helping to rebrand the Department of Water & Sewer Utilities and upgrading the City’s infrastructure as the City works to replace every lead service line, upgrade to its water treatment plant. He is a dedicated public servant who has, and continues to, give back to his native community.

G. Tracy Mehan, III, Executive Director, Government Affairs, American Water Works Association.